Can patents increase funding and valuation for growing companies? The data says…

Pitchbook compiled a list of the 80 VC-backed companies that have gone through an IPO in 2018 and we performed some research* on the list to explore the connection between patent activity and IPO. What did we find? Here’s the breakdown.

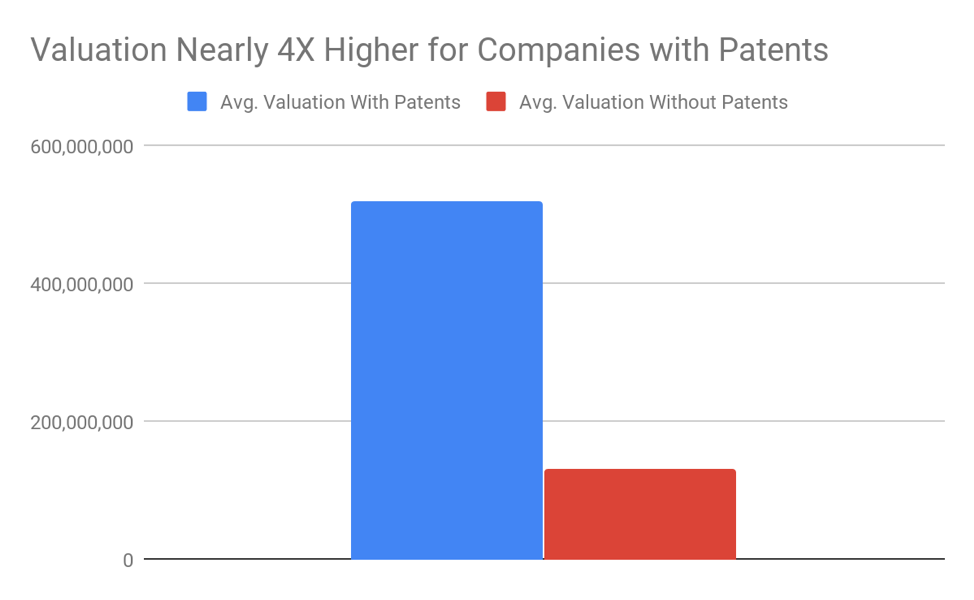

- 100% of companies valued at $150M or higher at IPO own or license patents (80% of the companies)

- The three companies that did not either own or license patents fell in the bottom 20% in terms of valuation at IPO

- Avg. valuation with patents $519.8M (owned or licensed)

- Avg. valuation without patents $131.3M

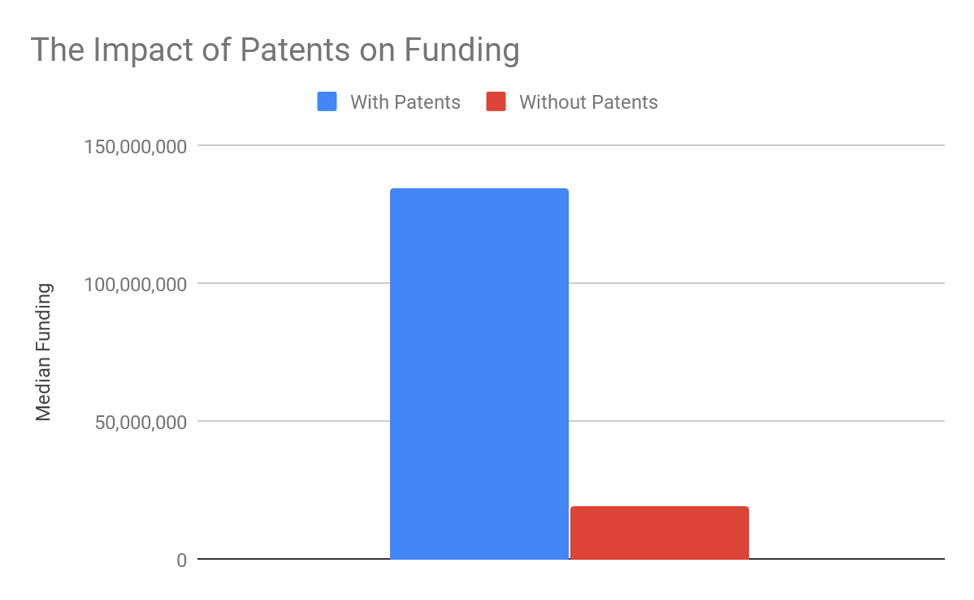

- Avg. funding with patents $135.75 (owned or licensed)

- Avg. funding without patents $35.03M

For VC-backed companies, obtaining funding is one of the most important goals because it provides the opportunity to hire the right staff, dedicate more money to developing products and securing a place in the market through effective sales and marketing.

The valuations of companies with patents were, on average, nearly 4 times as high as those without patents. While one should not expect patents to automatically deliver such a staggering jump in value, it should be noted that an Office of Chief Economist Report found that owning patents caused valuations to be higher for both first and second round funding at a rate of 23% and 29%, respectively.

Want to learn how startups can benefit from patents? Grab your free copy of The 30-Minute Patent MBA.

*The data presented in this report is based on publicly available USPTO data as of November 16, 2018. Patent applications that have not yet been published or were filed in countries other than the U.S. are not reflected in this report. Also, companies may own additional assets that have been acquired through acquisition, but USPTO assignment records do not always accurately reflect this.

TurboPatent has no affiliation with Pitchbook. All of the data presented in this report was collected from publicly available records provided by the USPTO.